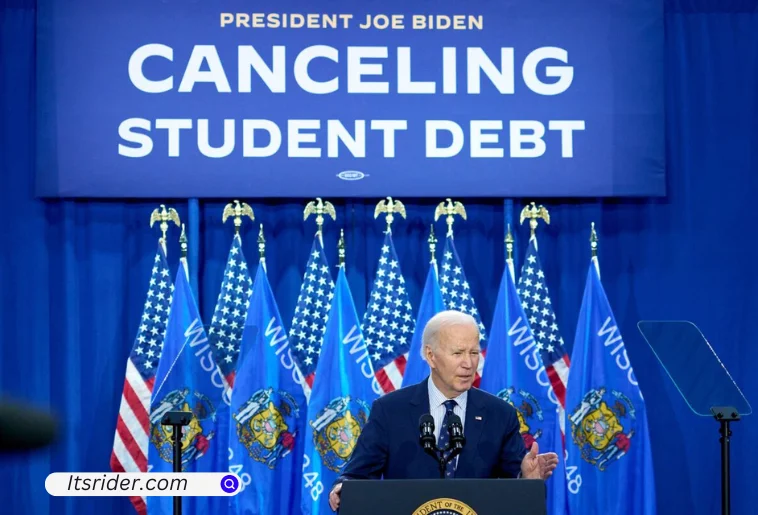

In a significant move aimed at providing financial relief to borrowers, President Joe Biden has announced the cancellation of $1.2 billion in student loan debt. This initiative will impact approximately 153,000 borrowers who are part of the Saving on a Valuable Education (SAVE) repayment plan. Here’s a detailed look at who will benefit from this debt cancellation and how it fits into the broader landscape of Biden’s student loan policies.

The SAVE Plan: An Overview

The SAVE plan, launched by the Biden administration, is an income-driven repayment (IDR) plan designed to make student loan payments more affordable. Payments are calculated based on a borrower’s income and family size rather than the loan balance. The plan ensures that as long as borrowers make their monthly payments, their loan balances will not grow due to unpaid interest. Starting in July, the plan also cuts undergraduate loan payments in half, capping them at 5% of discretionary income.

Who Qualifies for the Debt Cancellation?

Eligibility Criteria

To qualify for this recent round of debt cancellation, borrowers must be enrolled in the SAVE plan, have been in repayment for at least 10 years, and hold $12,000 or less in student loan debt. Borrowers with larger debts will receive relief after making payments for an additional year for every extra $1,000 borrowed.

Targeted Beneficiaries

This policy particularly benefits community college students and other borrowers with smaller loan amounts. The Department of Education has identified 153,000 borrowers who will have their debts discharged starting this week. Additionally, efforts are being made to contact other eligible borrowers to encourage them to enroll in the SAVE plan to qualify for future relief.

Impact on Borrowers

Immediate Relief

Borrowers who qualify for this debt cancellation will receive notifications via email from President Biden, informing them of their relief. The immediate discharge of their student loans will significantly ease their financial burdens, providing them with greater economic stability and the ability to focus on other financial goals.

Long-Term Benefits

The shortened time to forgiveness under the SAVE plan means that many borrowers will become debt-free much faster than under previous repayment plans. For future community college borrowers, 85% are expected to be debt-free within 10 years. This accelerated forgiveness timeline is a crucial step toward reducing the long-term financial strain on borrowers.

The Broader Context of Biden’s Student Loan Policies

Historical Debt Relief

Since taking office, President Biden has approved nearly $138 billion in student debt cancellation for almost 3.9 million borrowers. This includes various initiatives such as Public Service Loan Forgiveness (PSLF), income-driven repayment improvements, and relief for borrowers with disabilities or those affected by school closures.

Overcoming Legislative Hurdles

Biden’s administration has faced significant challenges in implementing broad student debt relief, particularly following the Supreme Court’s decision to block his $400 billion debt relief plan. Despite these setbacks, Biden has continued to pursue executive actions to provide targeted relief to millions of borrowers.

The Financial Implications

Cost of the SAVE Plan

According to the Penn Wharton budget model, the SAVE plan will incur a net cost of $475 billion over a 10-year budget window. This substantial investment underscores the administration’s commitment to easing the student debt burden on millions of Americans.

Economic Benefits

The relief provided by the SAVE plan is expected to have significant economic benefits. By reducing monthly payments and accelerating debt forgiveness, borrowers will have more disposable income to spend on other necessities, thereby boosting the economy. Additionally, the elimination of debt for lower-income borrowers can lead to increased economic mobility and stability.

Criticism and Support

Support from Borrowers and Advocates

Many borrowers and advocacy groups have lauded the Biden administration’s efforts to provide substantial debt relief. The accelerated forgiveness timeline and the focus on borrowers with smaller debts are seen as positive steps toward making higher education more accessible and less financially burdensome.

Criticism from Opponents

However, there has been criticism from some quarters, including claims that such widespread debt forgiveness is unfair to those who have already paid off their loans or chose not to take on debt. Critics also argue about the long-term financial impact of such policies on taxpayers and the federal budget.

Conclusion

President Biden’s decision to cancel $1.2 billion in student loan debt marks a significant step in his administration’s ongoing efforts to address the student debt crisis. By targeting borrowers in the SAVE plan and accelerating the timeline for debt forgiveness, this policy aims to provide immediate and long-term financial relief to those most in need. While the initiative has garnered both support and criticism, its impact on borrowers’ lives and the broader economy is undeniably profound.

As the Biden administration continues to navigate the complexities of student loan policies, the focus remains on creating pathways to financial stability and economic opportunity for millions of Americans burdened by student debt.

Read More: Taurus Season: Embracing Stability and Sensuality